Printable Schedule C Worksheet

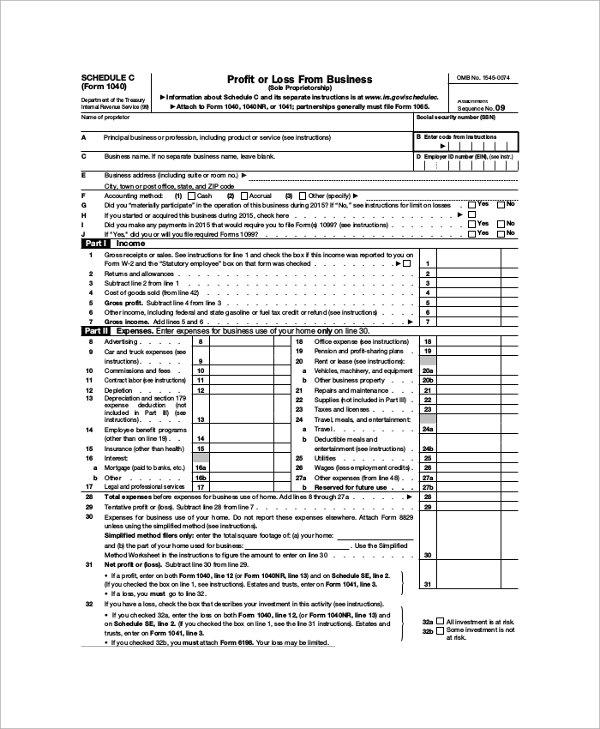

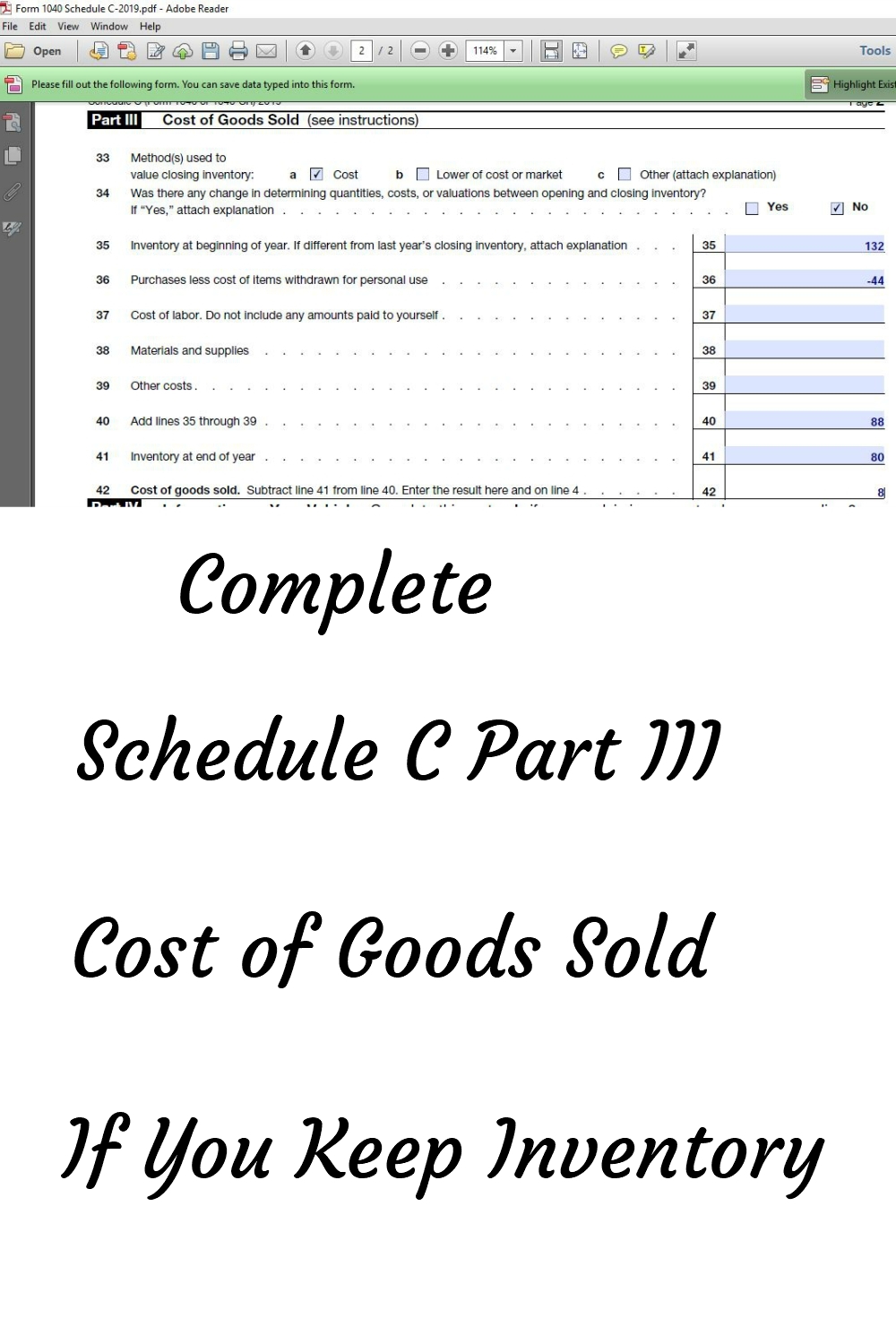

Printable Schedule C Worksheet - Partnerships must generally file form 1065. Schedule c (form 1040) department of the treasury internal revenue service. Go to www.irs.gov/scheduled for instructions and the latest information. Partnerships must generally file form 1065. For instructions and the latest information. An activity qualifies as a business if Schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity. Includes recent updates, related forms, and instructions on how to file. Partnerships generally must file form 1065. Go to www.irs.gov/schedulec for instructions and the latest information. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if For instructions and the latest information. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity. Go to www.irs.gov/scheduled for instructions and the latest information. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor; Partnerships must generally file form 1065. 30,000+ requests a dayhire the right procompare top pros Includes recent updates, related forms, and instructions on how to file. Partnerships must generally file form 1065. For instructions and the latest information. Partnerships must generally file form 1065. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession. Partnerships must generally file form 1065. Schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information. An activity qualifies as a business if Go to www.irs.gov/schedulec for instructions and the latest information. Partnerships must generally file form 1065. Go to www.irs.gov/scheduled for instructions and the latest information. Schedule c (form 1040) department of the treasury internal revenue service. For instructions and the latest information. Partnerships generally must file form 1065. Partnerships must generally file form 1065. Schedule c (form 1040) department of the treasury internal revenue service. For instructions and the latest information. 30,000+ requests a dayhire the right procompare top pros An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity. An activity qualifies. Partnerships must generally file form 1065. Partnerships must generally file form 1065. An activity qualifies as a business if Includes recent updates, related forms, and instructions on how to file. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor; An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Use schedule c (form 1040). For instructions and the latest information. 4/5 (125 reviews) Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor; Go to www.irs.gov/schedulec for instructions and the latest information. Use form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9,. Schedule c (form 1040) department of the treasury internal revenue service. Partnerships must generally file form 1065. An activity qualifies as a business if Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Go to www.irs.gov/schedulec for instructions and the latest information. Partnerships must generally file form 1065. For instructions and the latest information. Go to www.irs.gov/scheduled for instructions and the latest information. 30,000+ requests a dayhire the right procompare top pros Partnerships must generally file form 1065. 30,000+ requests a dayhire the right procompare top pros Partnerships must generally file form 1065. Schedule c (form 1040) department of the treasury internal revenue service. Go to www.irs.gov/schedulec for instructions and the latest information. Go to www.irs.gov/scheduled for instructions and the latest information. Schedule c (form 1040) department of the treasury internal revenue service. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor; 30,000+ requests a dayhire the right procompare top pros Use form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10. 4/5 (125 reviews) Partnerships must generally file form 1065. Go to www.irs.gov/schedulec for instructions and the latest information. An activity qualifies as a business if Partnerships must generally file form 1065. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Includes recent updates, related forms, and instructions on how to file. Schedule c (form 1040) department of the treasury internal revenue service. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity. For instructions and the latest information.Schedule C Worksheet Excel Printable And Enjoyable Learning

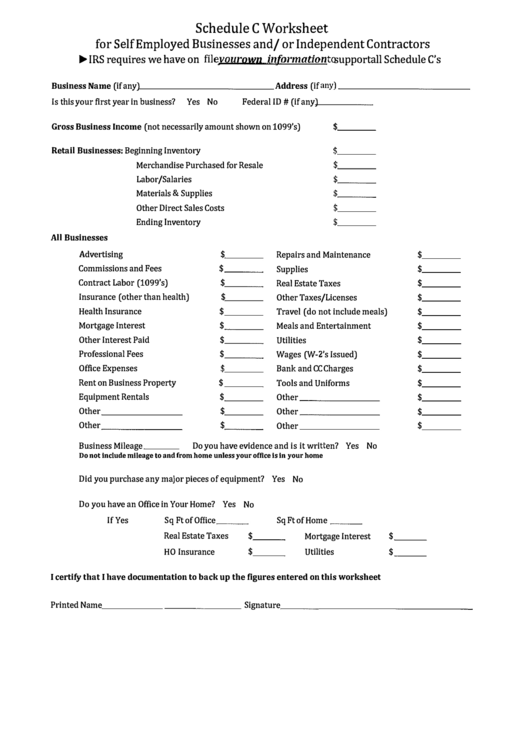

Fillable Schedule C Worksheet For Self Employed Businesses And/or

Schedule C In Excel Format

Printable Schedule C Worksheet

FREE 9+ Sample Schedule C Forms in PDF MS Word

Schedule C And Expense Worksheet

Fillable Online Schedule C Worksheet for Self Employed Businesses and

1040 Spreadsheet with regard to Schedule C Expenses Spreadsheet Then

Schedule C Calculation Worksheet

Fillable Online Schedule C Worksheet.docx Fax Email Print pdfFiller

Schedule C (Form 1040) Department Of The Treasury Internal Revenue Service (99) Profit Or Loss From Business (Sole Proprietorship) Go To Www.irs.gov/Schedulec For Instructions And The Latest Information.

Partnerships Must Generally File Form 1065.

An Activity Qualifies As A Business If

Partnerships Must Generally File Form 1065.

Related Post:

:max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)