Printable 2290 Form

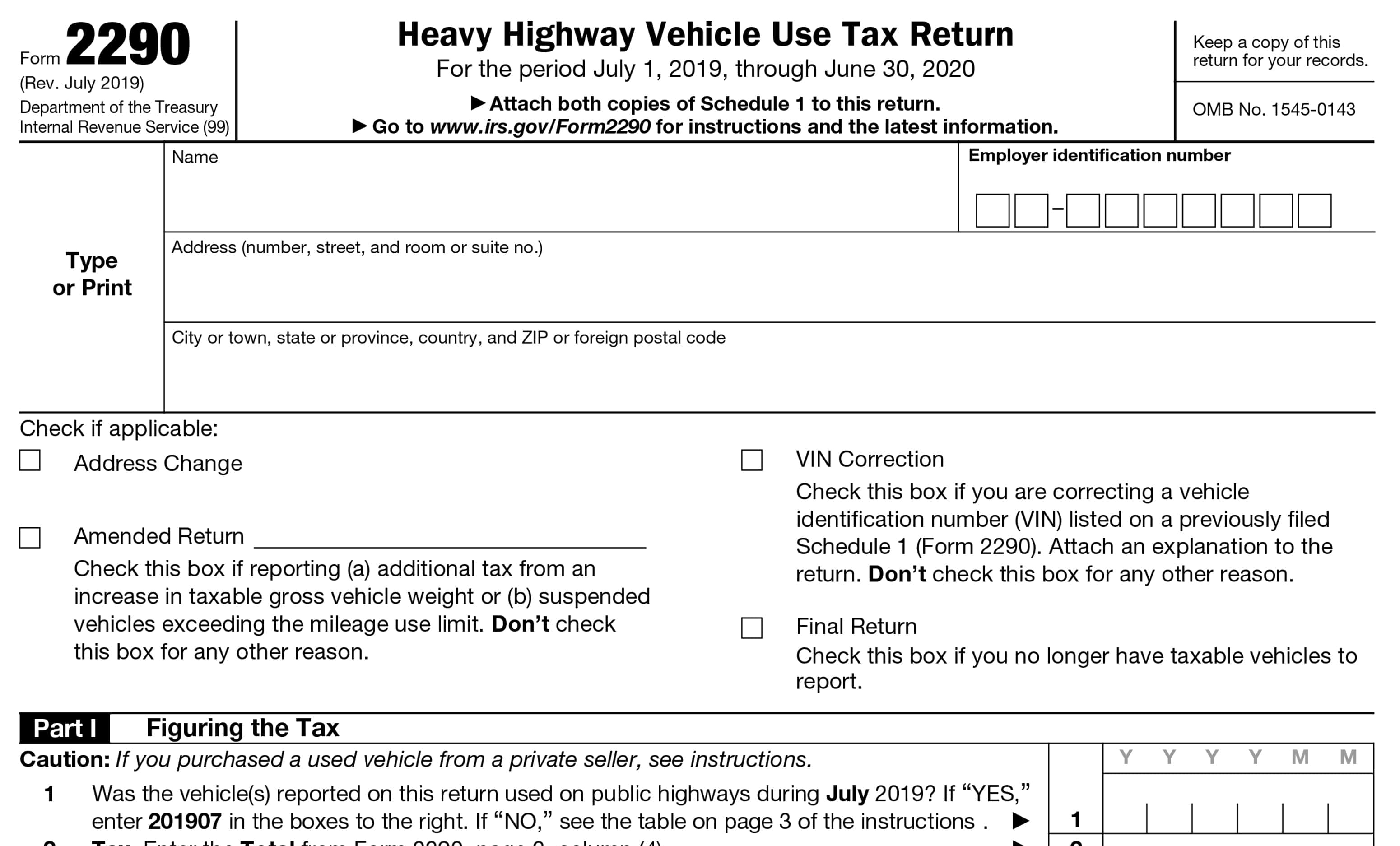

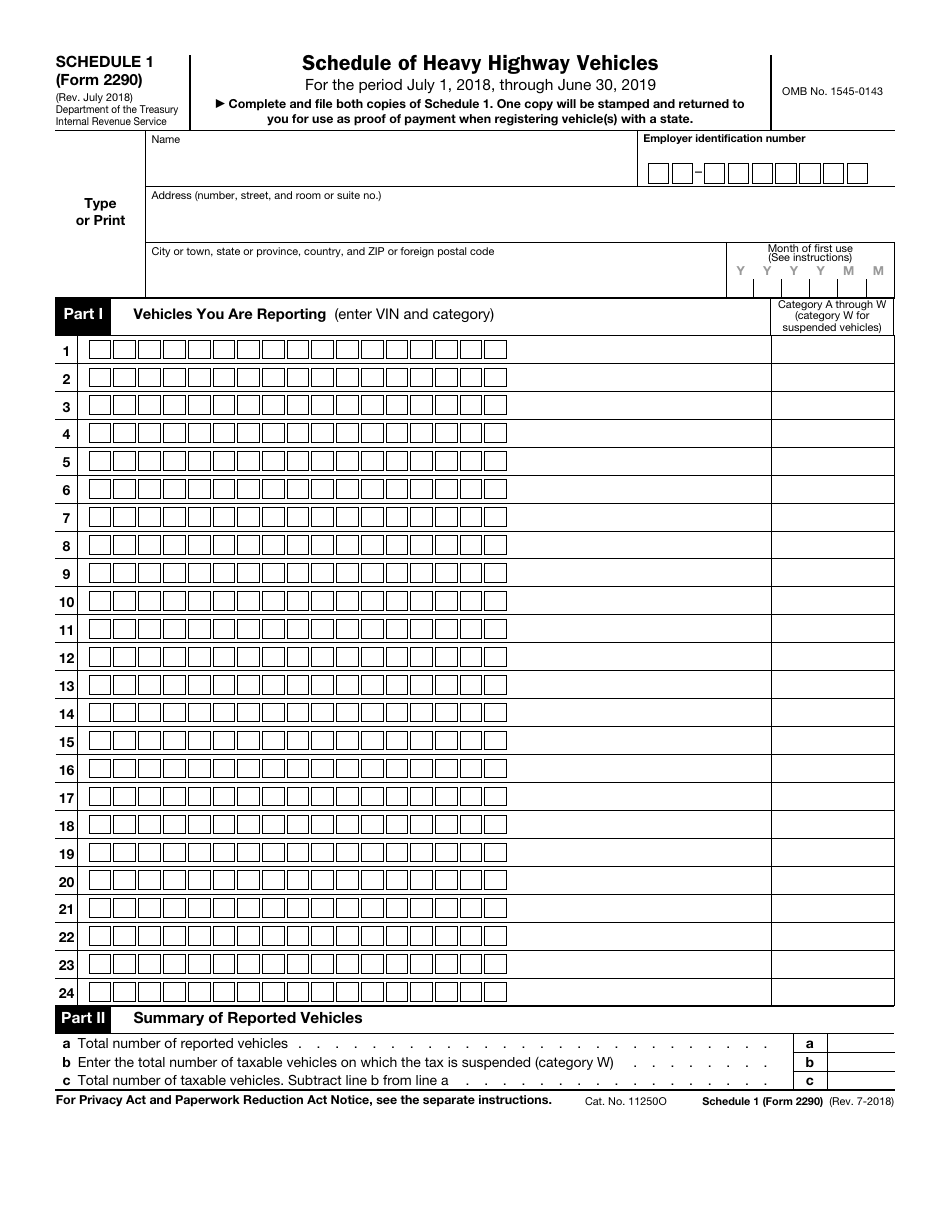

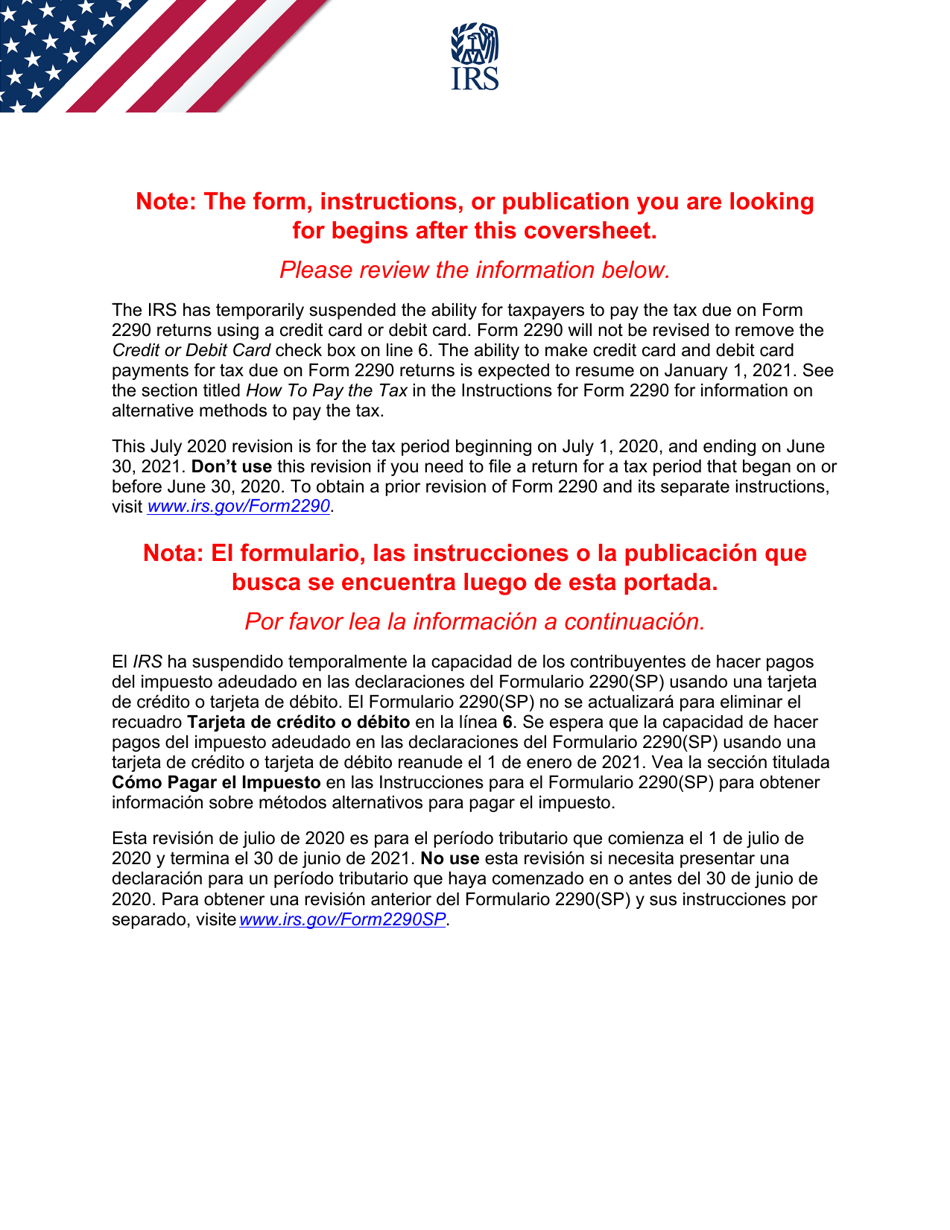

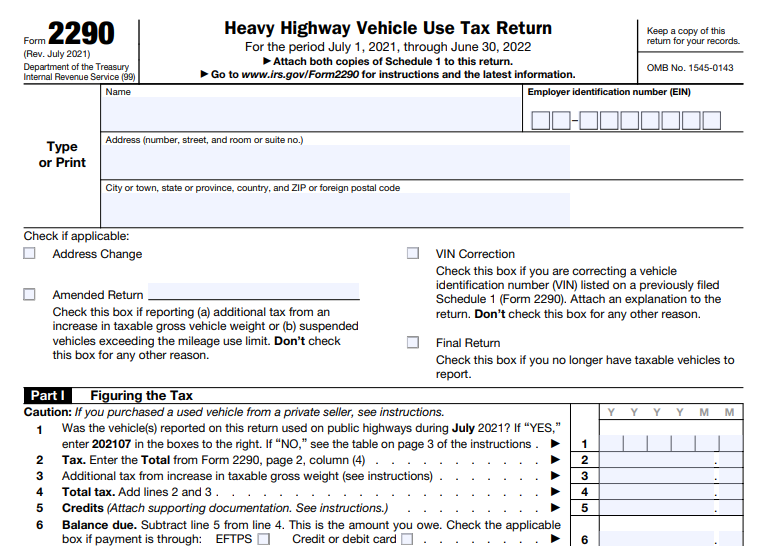

Printable 2290 Form - July 2022) department of the treasury internal revenue service. Use form 2290 for the following actions. Click on appropriate link which lets you get this form as pdf file. July 2020) departrnent of the treasury internal revenue service (99) name heavy highway vehicle use tax return for the period july 1 , 2020, through june 30, 2021 attach both copies of schedule 1 to this return. The final steps ensure that your filing is complete, compliant, and ready for irs processing. This irs form 2290 is used for reporting heavy highway vehicle use tax. Get 📝 irs form 2290: Fill out the heavy highway vehicle use tax return online and print it out for free. Keep a copy of this return for your records. • figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 It covers the tax period from july 1, 2020, to june 30, 2021. Fill out the heavy highway vehicle use tax return online and print it out for free. Known as the heavy highway vehicle use tax return, this form is used to report and pay the annual federal highway use tax on vehicles with a gross weight of 55,000 pounds or more. The final steps ensure that your filing is complete, compliant, and ready for irs processing. Keep a copy of this return for your records. Once you’ve chosen a payment method and reviewed your form 2290 for accuracy, it’s time to submit your return. July 2020) departrnent of the treasury internal revenue service (99) name heavy highway vehicle use tax return for the period july 1 , 2020, through june 30, 2021 attach both copies of schedule 1 to this return. You must file this form 2290 (rev. The purpose of this form is for the truck driver to calculate and pay any taxes that may be due on the use of a motor vehicle with a gross weight of at least 55,000 lbs. • figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 Para obtener una revisión anterior del formulario 2290 (sp) y sus instrucciones por separado, visite www.irs.gov/form2290sp. Getting printable form 2290 couldn’t be easier. Once you’ve chosen a payment method and reviewed your form 2290 for accuracy, it’s time to submit your return. July 2022) department of the treasury internal revenue service. It is also known as a heavy highway vehicle. Attach both copies of schedule 1 to this return. Be sure to attach both copies of schedule 1 with your submission. Understanding the submission process for form 2290. July 2019) for the tax period beginning on july 1, 2019, and ending on june 30, 2020. Known as the heavy highway vehicle use tax return, this form is used to report. July 2022) department of the treasury internal revenue service. The purpose of this form is for the truck driver to calculate and pay any taxes that may be due on the use of a motor vehicle with a gross weight of at least 55,000 lbs. Use search function on site to find form number 2290. Irs form 2290 is used. Get 📝 irs form 2290: Print multiple copies of the stamped schedule 1. Go to www.irs.gov/form2290 for instructions and the latest information. Keep a copy of this return for your records. Simply follow these steps to download and print the form from the irs website: The purpose of this form is for the truck driver to calculate and pay any taxes that may be due on the use of a motor vehicle with a gross weight of at least 55,000 lbs. To obtain a prior revision of form 2290 and its separate instructions, visit irs.gov/form2290. Go to www.irs.gov/form2290 for instructions and the latest information. Keep. One copy will be stamped and returned to you for use as proof of payment when registering your vehicle(s) with a state. Click on appropriate link which lets you get this form as pdf file. Print multiple copies of the stamped schedule 1. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles.. For truck owners and operators in the united states, printable form 2290 is essential to tax compliance. Go to www.irs.gov/form2290 for instructions and the latest information. Use form 2290 for the following actions. If a pdf file won't open, try downloading the file to your device and opening it using adobe acrobat. This irs form 2290 is used for reporting. Complete and file both copies of schedule 1. Simply follow these steps to download and print the form from the irs website: Click on appropriate link which lets you get this form as pdf file. The purpose of this form is for the truck driver to calculate and pay any taxes that may be due on the use of a. Attach both copies of schedule 1 to this return. Keep a copy of this return for your records. The purpose of the tax is to help fund the construction and maintenance of the nation's public highway system. Use form 2290 for the following actions. Browse 11 form 2290 templates collected for any of your needs. Be sure to attach both copies of schedule 1 with your submission. Getting printable form 2290 couldn’t be easier. Keep a copy of this return for your records. Irs form 2290 is used by truck drivers as part of their federal tax return. Simply follow these steps to download and print the form from the irs website: Go to www.irs.gov/form2290 for instructions and the latest information. Information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Go to www.irs.gov/form2290 for instructions and the latest information. Print a copy for your records. Simply follow these steps to download and print the form from the irs website: Click on a column heading to sort the list by the contents of that column. The latest versions of irs forms, instructions, and publications. It covers the tax period from july 1, 2020, to june 30, 2021. Keep a copy of this return for your records. July 2022) department of the treasury internal revenue service. Get 📝 irs form 2290: Complete and file both copies of schedule 1. Use form 2290 for the following actions. Click on appropriate link which lets you get this form as pdf file. Irs form 2290 is used by truck drivers as part of their federal tax return. July 2020) departrnent of the treasury internal revenue service (99) name heavy highway vehicle use tax return for the period july 1 , 2020, through june 30, 2021 attach both copies of schedule 1 to this return.Irs Form 2290 Printable 2021

2290 Form Printable

File 201920 Form 2290 Electronically 2290 Schedule 1

IRS Form 2290 Fill Out, Sign Online and Download Fillable PDF

Pay your heavy highway use taxes with form 2290 and stay on the road

Download Instructions for IRS Form 2290 Heavy Highway Vehicle Use Tax

IRS Form 2290 Printable for 202324 Download 2290 for 14.90

Fillable Online File IRS Form 2290 OnlineHeavy Vehicle Use Tax (HVUT

Fillable Form 2290 Heavy Highway Vehicle Use Tax Return printable pdf

Form 2290 Heavy Highway Vehicle Use Tax Online Reporting

To Obtain A Prior Revision Of Form 2290 And Its Separate Instructions, Visit Irs.gov/Form2290.

Understanding The Submission Process For Form 2290.

Don’t Use This Revision If You Need To File A Return For A Tax Period That Began On Or Before June 30, 2019.

The Form 2290 Is A Tax Form Used To Calculate And Report The Excise Tax Owed On Highway Motor Vehicles.

Related Post: