Is There A Printable 1099 Form

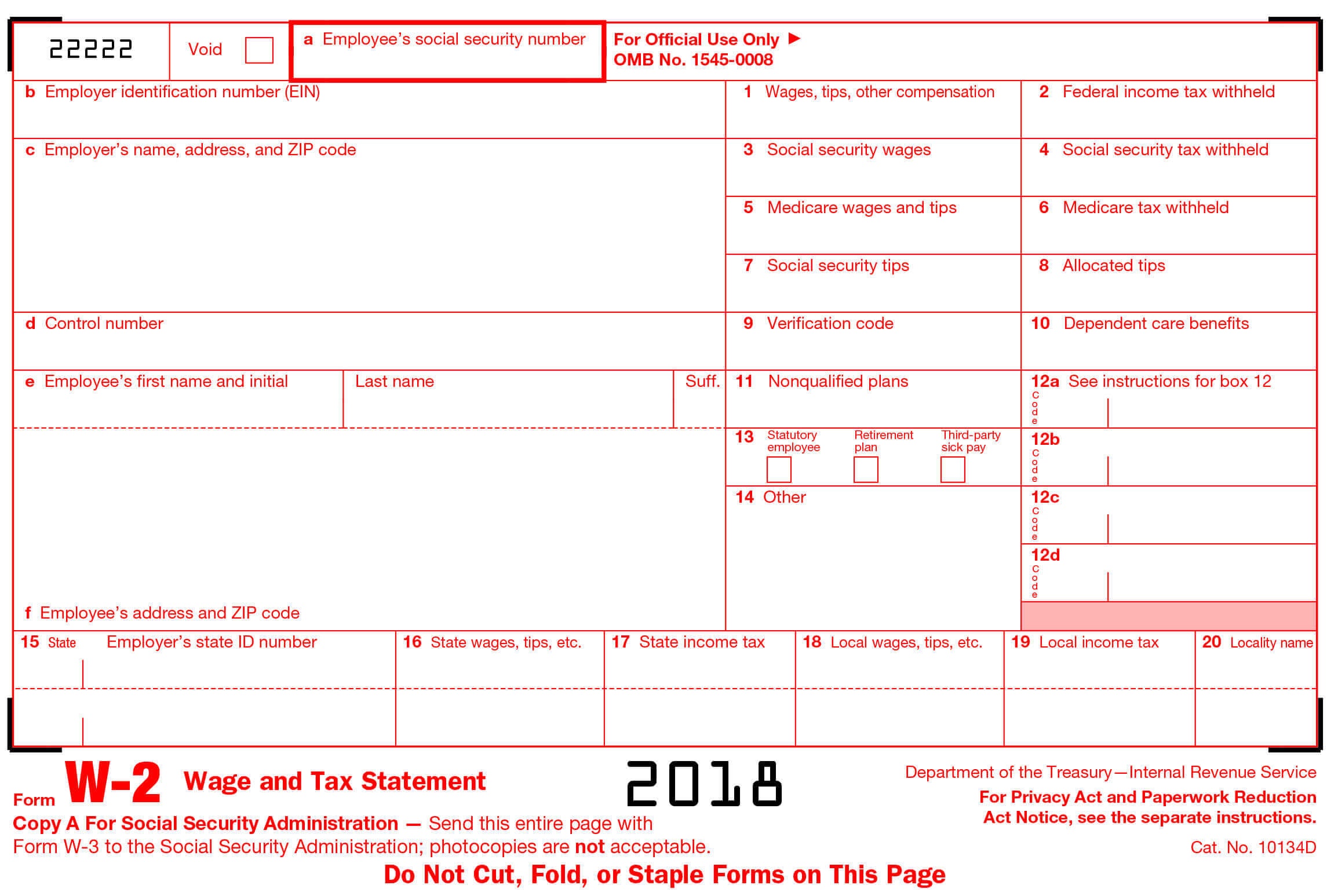

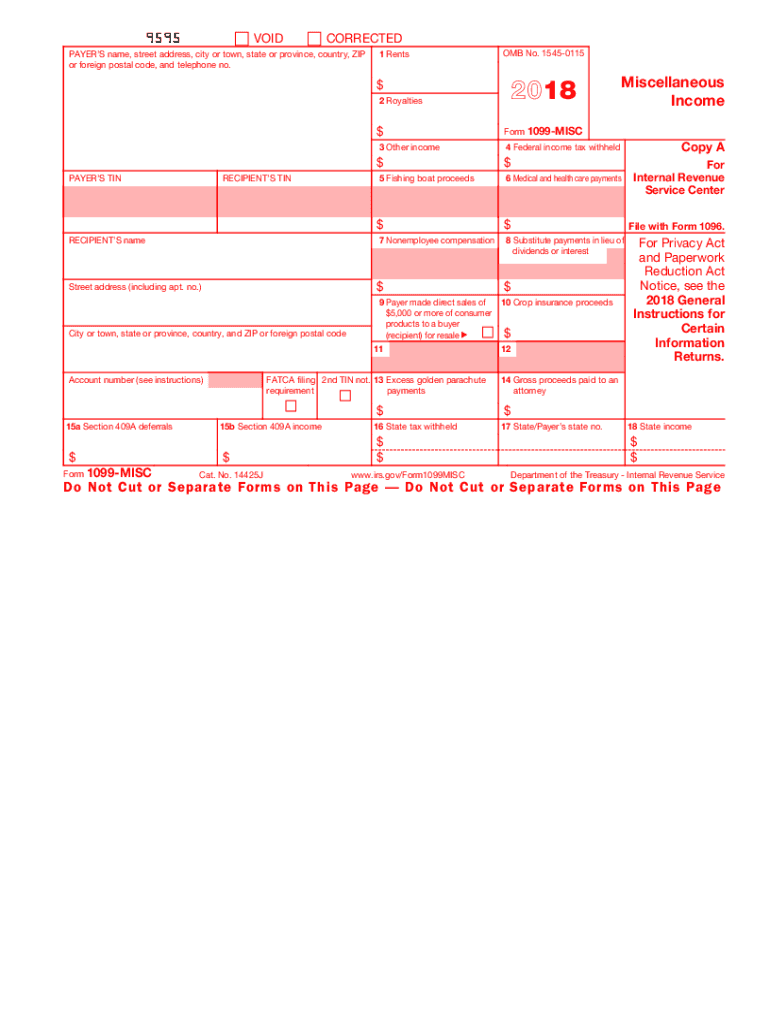

Is There A Printable 1099 Form - A single form may report multiple types. Please note that copy b and. See part o in the current general instructions for certain information returns, available at www.irs.gov/form1099, for more information about penalties. Simply hit download, fill in your details, and send it in to the irs. Select get started for the 1099 form you want to create. There are nearly two dozen different kinds of 1099 forms, and each reports a different type of income to the irs. How much do i need to earn to use a. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system. Follow these steps to create your 1099s. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance. A single form may report multiple types. Please note that copy b and. Follow these steps to create your 1099s. Select get started for the 1099 form you want to create. 1099 copy b forms using the pressure seal filing method will print 1 form per sheet. Simply hit download, fill in your details, and send it in to the irs. Accountinginsights team published feb 15, 2025 See part o in the current general instructions for certain information returns, available at www.irs.gov/form1099, for more information about penalties. You must also complete form 8919 and attach it to your return. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system. These “continuous use” forms no longer include the tax year. A single form may report multiple types. Go to www.irs.gov/freefile to see if you qualify for no. There are nearly two dozen different kinds of 1099 forms, and each reports. The iris taxpayer portal is available. These “continuous use” forms no longer include the tax year. See part o in the current general instructions for certain information returns, available at www.irs.gov/form1099, for more information about penalties. Go to www.irs.gov/freefile to see if you qualify for no. You must also complete form 8919 and attach it to your return. There are nearly two dozen different kinds of 1099 forms, and each reports a different type of income to the irs. Please note that copy b and. 1099 copy b forms using the pressure seal filing method will print 1 form per sheet. Simply hit download, fill in your details, and send it in to the irs. Follow these steps. Learn how to access, print, and submit 1099 forms from the irs, ensuring compliance and legibility for accurate tax reporting. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance. Accountinginsights team published feb 15, 2025 The iris taxpayer portal is available.. Go to www.irs.gov/freefile to see if you qualify for no. Accountinginsights team published feb 15, 2025 Your tax form is on time if it is properly addressed and mailed on or before the due. There are nearly two dozen different kinds of 1099 forms, and each reports a different type of income to the irs. Follow these steps to create. There are nearly two dozen different kinds of 1099 forms, and each reports a different type of income to the irs. 1099 copy b forms using the pressure seal filing method will print 1 form per sheet. Go to www.irs.gov/freefile to see if you qualify for no. Business taxpayers can file electronically any form 1099 series information returns for free. These “continuous use” forms no longer include the tax year. Please note that copy b and. You must also complete form 8919 and attach it to your return. See part o in the current general instructions for certain information returns, available at www.irs.gov/form1099, for more information about penalties. Select get started for the 1099 form you want to create. Learn how to access, print, and submit 1099 forms from the irs, ensuring compliance and legibility for accurate tax reporting. Go to www.irs.gov/freefile to see if you qualify for no. See part o in the current general instructions for certain information returns, available at www.irs.gov/form1099, for more information about penalties. Business taxpayers can file electronically any form 1099 series information. A single form may report multiple types. 1099 copy b forms using the pressure seal filing method will print 1 form per sheet. Learn how to access, print, and submit 1099 forms from the irs, ensuring compliance and legibility for accurate tax reporting. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system. How much do i need to earn to use a. Follow these steps to create your 1099s. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary. Accountinginsights team published feb 15, 2025 A single form may report multiple types. See part o in the current general instructions for certain information returns, available at www.irs.gov/form1099, for more information about penalties. You must also complete form 8919 and attach it to your return. Learn how to access, print, and submit 1099 forms from the irs, ensuring compliance and legibility for accurate tax reporting. Your tax form is on time if it is properly addressed and mailed on or before the due. The iris taxpayer portal is available. There are nearly two dozen different kinds of 1099 forms, and each reports a different type of income to the irs. Follow these steps to create your 1099s. These “continuous use” forms no longer include the tax year. Select get started for the 1099 form you want to create. 1099 copy b forms using the pressure seal filing method will print 1 form per sheet. Go to www.irs.gov/freefile to see if you qualify for no. Simply hit download, fill in your details, and send it in to the irs.1099 Tax Form Printable Excel Printable Forms Free Online

1099 Printable Forms

1099 Form Fillable Pdf Printable Forms Free Online

1099 Form Printable 2023

Print Blank 1099 Form Printable Form, Templates and Letter

1099 Printable Forms Printable Word Searches

Free Printable 1099 Form 2018 Free Printable

Printable Blank 1099 Form

Can You Print 1099 Forms From a Regular Printer? Everything You Need to

1099 Printable Forms

Irs 1099 Forms Are A Series Of Tax Reporting Documents Used By Businesses And Individuals To Report Income Received Outside Of Normal Salary Or Wages, Such As Freelance.

How Much Do I Need To Earn To Use A.

Please Note That Copy B And.

Business Taxpayers Can File Electronically Any Form 1099 Series Information Returns For Free With The Irs Information Returns Intake System.

Related Post:

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)