Florida Inheritance Printable Disclaimer Form

Florida Inheritance Printable Disclaimer Form - Because of the risk of doing an incorrect disclaimer, it is advisable. Florida statute 739.104(3) explains what is required for a florida disclaimer of property to be effective. Find the template you need and use advanced editing tools to. Up to $40 cash back inheritance disclaimer form. A person may want to disclaim an inheritance or gift in order to maximize gift and estate tax exclusions, or simply because he or she does not want the property and/or the. The florida inheritance disclaimer form is a legal document that allows an individual to refuse or disclaim an inheritance from a deceased person's estate. Search for the papers you require in the most extensive. Create a custom, online disclaimer of inheritance with jotform sign. Fill out and sign from any device. Up to $40 cash back florida renunciation and disclaimer of right to inheritance or to inherit property from deceased — specific property in the state of florida, individuals have the legal. I have included a sample form of what is required to make a qualified disclaimer under a plan download file. This disclaimer of inheritance form allows legal heirs to formally refuse their inheritance rights. Up to $40 cash back inheritance disclaimer form. Find the template you need and use advanced editing tools to. Create a custom, online disclaimer of inheritance with jotform sign. A person may want to disclaim an inheritance or gift in order to maximize gift and estate tax exclusions, or simply because he or she does not want the property and/or the. Fill out and sign from any device. Search for the papers you require in the most extensive. If a beneficiary does not want the inheritance, a disclaimer. It covers crucial details such. Easy to customize and share. Create a custom, online disclaimer of inheritance with jotform sign. Find the template you need and use advanced editing tools to. The following must be met: I,_____ , the undersigned, being an heir of the estate of _____, deceased, hereby disclaims my right to receive any property from the estate of. I have included a sample form of what is required to make a qualified disclaimer under a plan download file. A person may want to disclaim an inheritance or gift in order to maximize gift and estate tax exclusions, or simply because he or she does not want the property and/or the. Up to $40 cash back inheritance disclaimer form.. Find the template you need and use advanced editing tools to. Florida statute 739.104(3) explains what is required for a florida disclaimer of property to be effective. The disclaimer must be in writing; The florida inheritance printable disclaimer form is an essential document that can provide beneficiaries with the flexibility to make choices about their inherited assets. I have included. Up to $40 cash back understanding the disclaiming process: Fill out and sign from any device. The florida inheritance disclaimer form is a legal document that allows an individual to refuse or disclaim an inheritance from a deceased person's estate. If a beneficiary does not want the inheritance, a disclaimer. Second, the disclaimer must be in writing and must be. Fill out and sign from any device. It is essential for ensuring the proper distribution of an estate according to the deceased's last will. Search for the papers you require in the most extensive. A person may want to disclaim an inheritance or gift in order to maximize gift and estate tax exclusions, or simply because he or she does. Up to $40 cash back inheritance disclaimer form. Search for the papers you require in the most extensive. Disclaimer of inheritance (pdf) author: The disclaimer must be in writing; I,_____ , the undersigned, being an heir of the estate of _____, deceased, hereby disclaims my right to receive any property from the estate of. Create a custom, online disclaimer of inheritance with jotform sign. Up to $40 cash back understanding the disclaiming process: This disclaimer of inheritance form allows legal heirs to formally refuse their inheritance rights. Find the template you need and use advanced editing tools to. The disclaimer must be in writing; A person may want to disclaim an inheritance or gift in order to maximize gift and estate tax exclusions, or simply because he or she does not want the property and/or the. Florida statute 739.104(3) explains what is required for a florida disclaimer of property to be effective. The florida inheritance printable disclaimer form is an essential document that can. Easy to customize and share. I have included a sample form of what is required to make a qualified disclaimer under a plan download file. The following must be met: A person may want to disclaim an inheritance or gift in order to maximize gift and estate tax exclusions, or simply because he or she does not want the property. If a beneficiary does not want the inheritance, a disclaimer. This disclaimer of inheritance form allows legal heirs to formally refuse their inheritance rights. I have included a sample form of what is required to make a qualified disclaimer under a plan download file. Up to $40 cash back florida renunciation and disclaimer of right to inheritance or to inherit. I have included a sample form of what is required to make a qualified disclaimer under a plan download file. The florida inheritance disclaimer form is a legal document that allows an individual to refuse or disclaim an inheritance from a deceased person's estate. It is essential for ensuring the proper distribution of an estate according to the deceased's last will. Create a custom, online disclaimer of inheritance with jotform sign. Second, the disclaimer must be in writing and must be delivered to the right person. The florida inheritance printable disclaimer form is an essential document that can provide beneficiaries with the flexibility to make choices about their inherited assets. Find the template you need and use advanced editing tools to. Florida statute 739.104(3) explains what is required for a florida disclaimer of property to be effective. The following must be met: A disclaimer inheritance form is a document that allows a beneficiary of an inheritance to avoid receiving the inheritance. It covers crucial details such. Search for the papers you require in the most extensive. Because of the risk of doing an incorrect disclaimer, it is advisable. The disclaimer must be in writing; Up to $40 cash back florida renunciation and disclaimer of right to inheritance or to inherit property from deceased — specific property in the state of florida, individuals have the legal. A person may want to disclaim an inheritance or gift in order to maximize gift and estate tax exclusions, or simply because he or she does not want the property and/or the.Disclaimer of inheritance form pdf Fill out & sign online DocHub

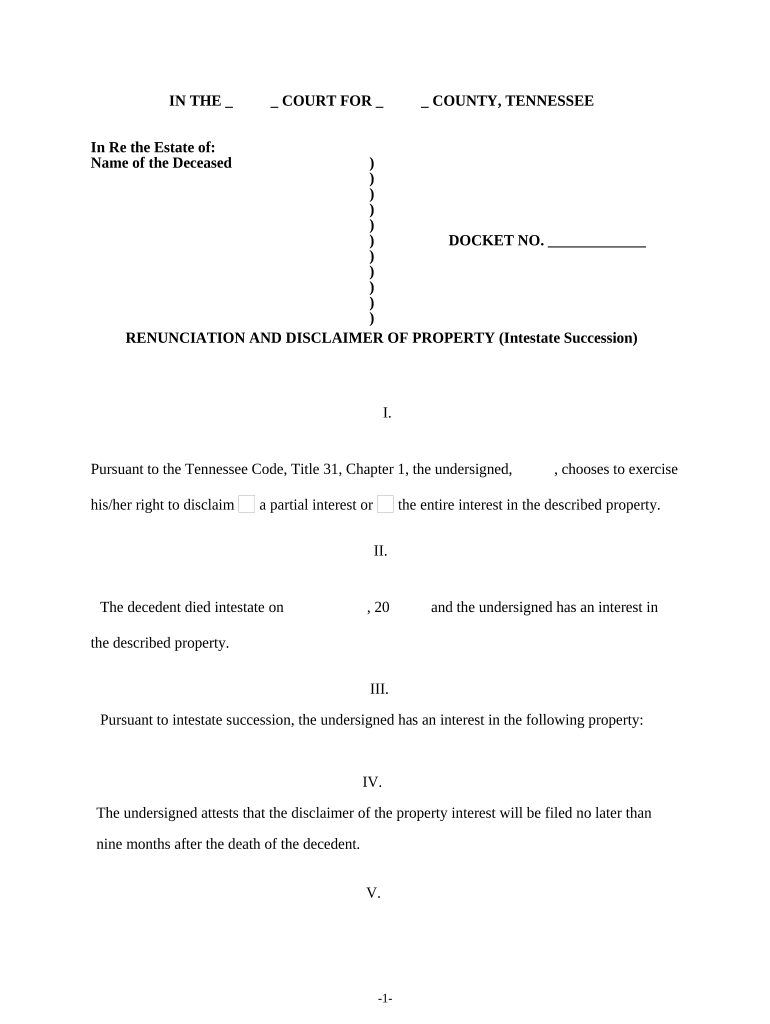

Inheritance Disclaimer Forms Printable For Employee To Sign US Legal

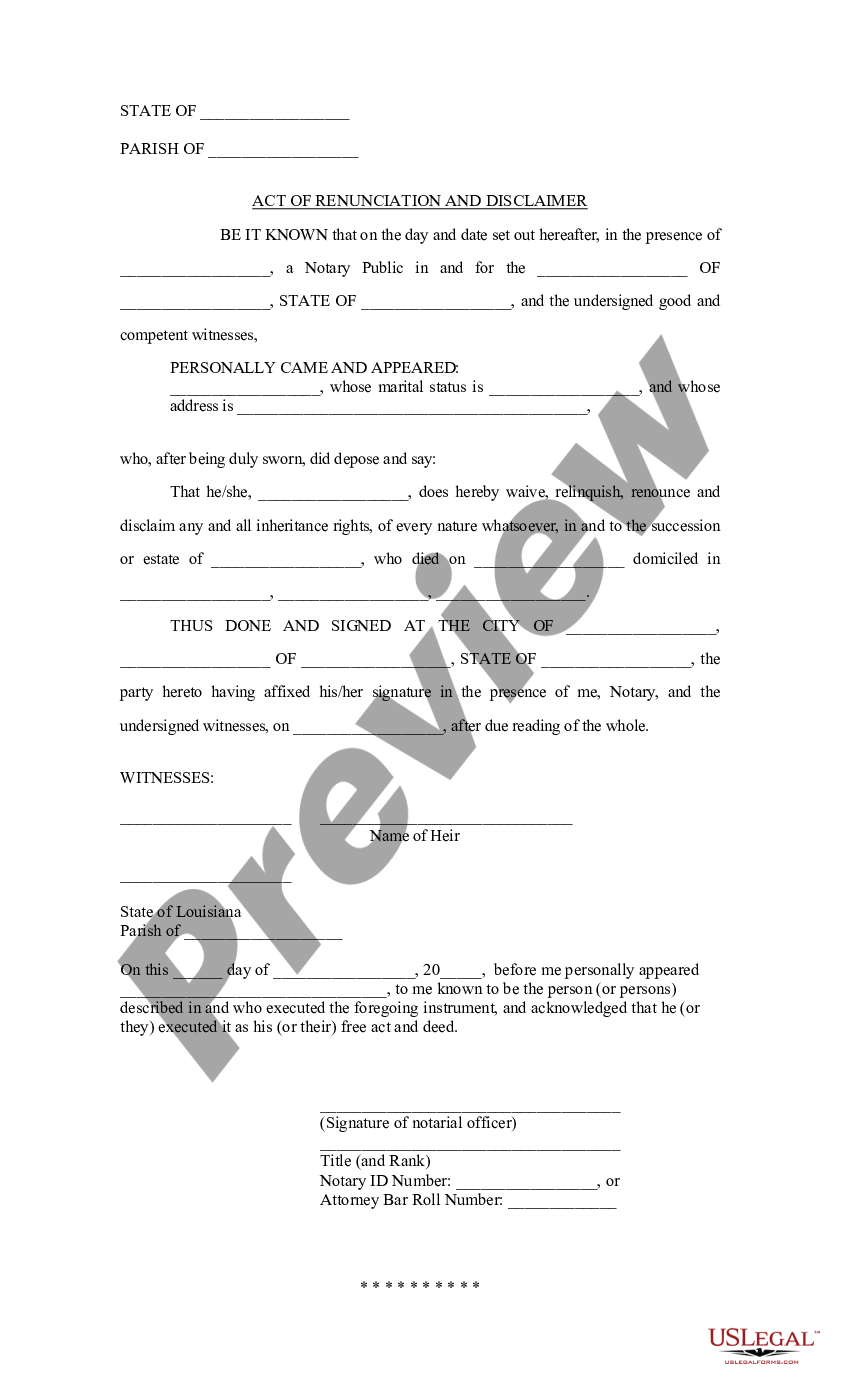

Louisiana Act of Renunciation and Disclaimer Renunciation Of

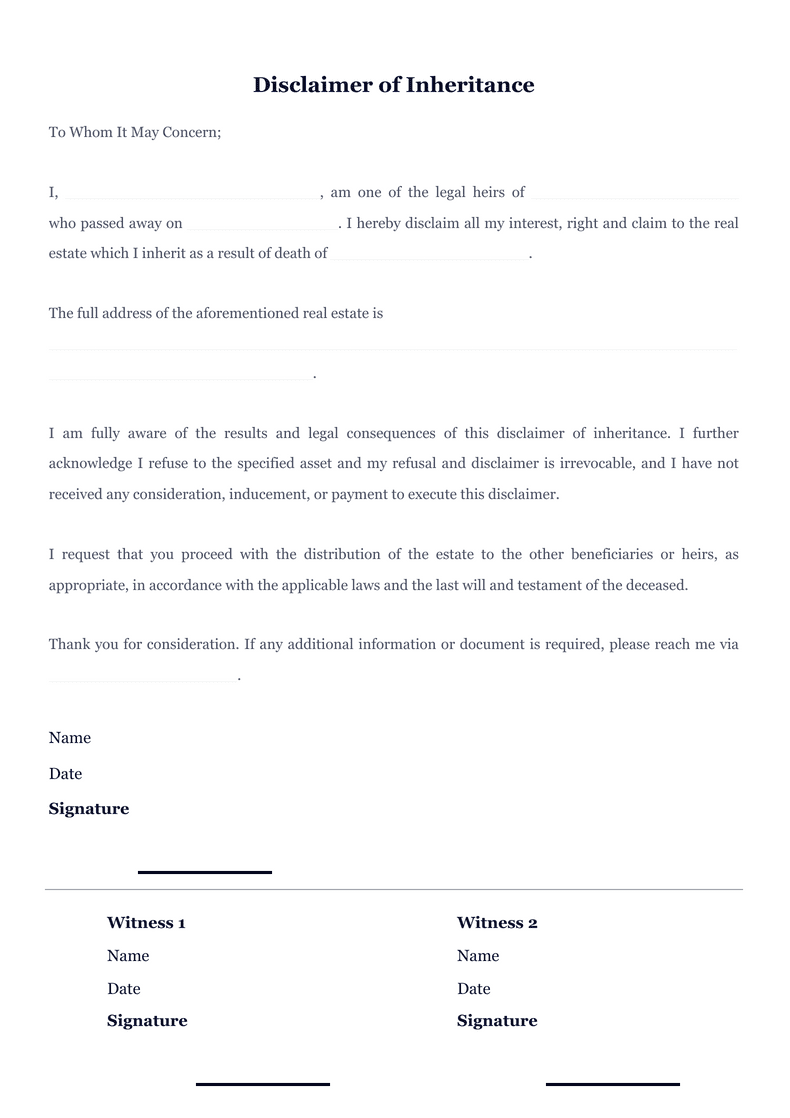

Disclaimer of Inheritance Sign Templates Jotform

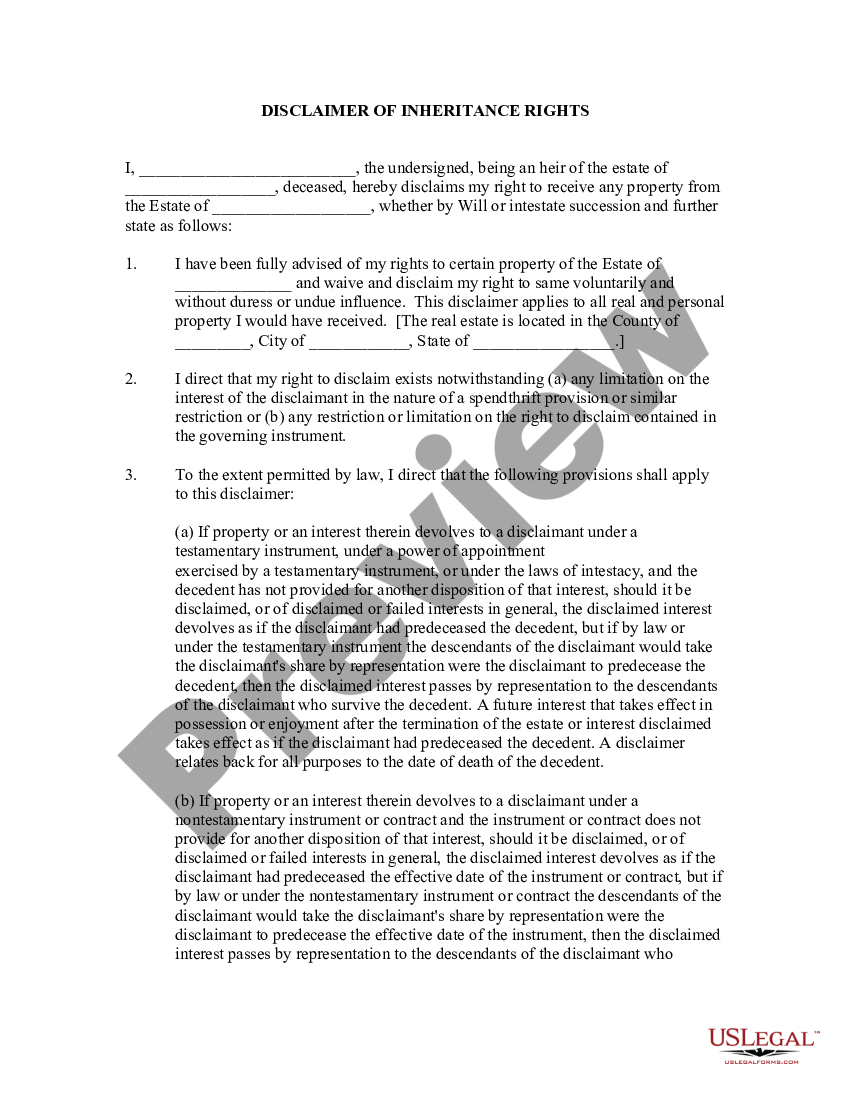

Broward Florida Disclaimer of Inheritance Rights for Stepchildren US

Disclaimer of Right to Inherit or Inheritance Disclaim Inheritance

inheritance tax waiver form florida Tarah Boyer

Disclaimer of interest form florida Fill out & sign online DocHub

Disclaimer Form Sample Fill Online, Printable, Fillable, Blank

Florida Disclaimer of Interest Forms

Fill Out And Sign From Any Device.

Up To $40 Cash Back Understanding The Disclaiming Process:

Easy To Customize And Share.

If A Beneficiary Does Not Want The Inheritance, A Disclaimer.

Related Post: